san antonio local sales tax rate 2019

You can print a 825 sales tax table here. San Antonio collects the maximum legal local sales tax.

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

2019 Official Tax Rates Exemptions.

. 4 rows San Antonio TX Sales Tax Rate. Combined Area Name Local Code Rate. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San Antonio has a higher sales tax than 100 of Texas other cities and counties. 12 San Antonio ATD.

Did South Dakota v. The current total local sales tax rate in San Antonio TX is 8250. Some cities and local governments in Bexar County collect additional local sales taxes which can be as high as 2.

The County sales tax rate is. The latest sales tax rate for San Antonio TX. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

Bexar Co Es Dis No 12. If you have questions about Local Sales and Use Tax rates or boundary information. San Antonio FL Sales Tax Rate.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. Higher maximum sales tax than any other Texas counties. Maintenance Operations MO and Debt Service.

The Texas sales tax of 625 applies countywide. The Official Tax Rate. 1000 City of San Antonio.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. Texas Comptroller of Public Accounts. Sales Tax Rate Changes in Major Cities.

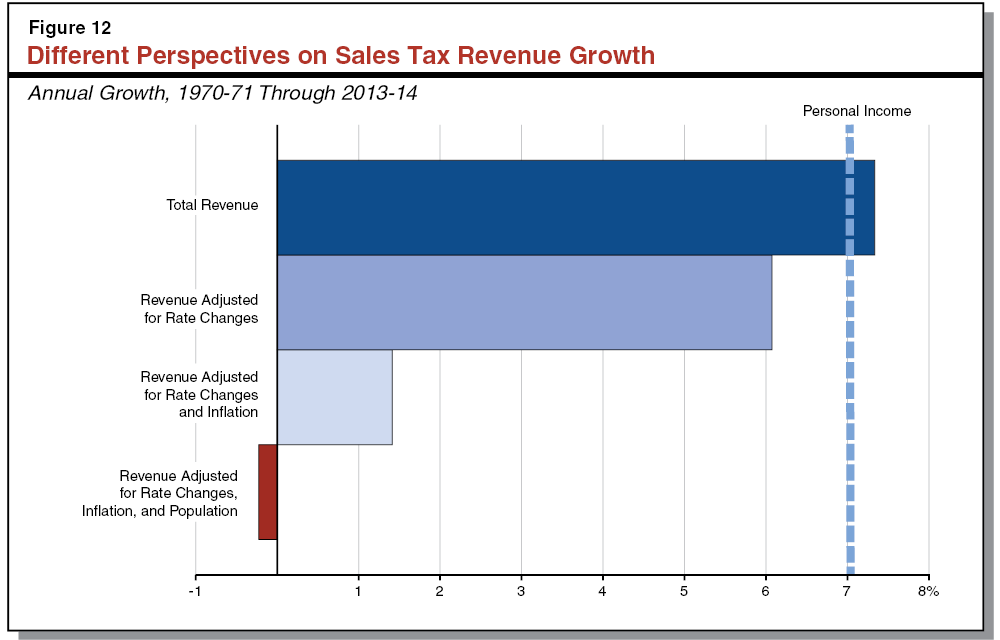

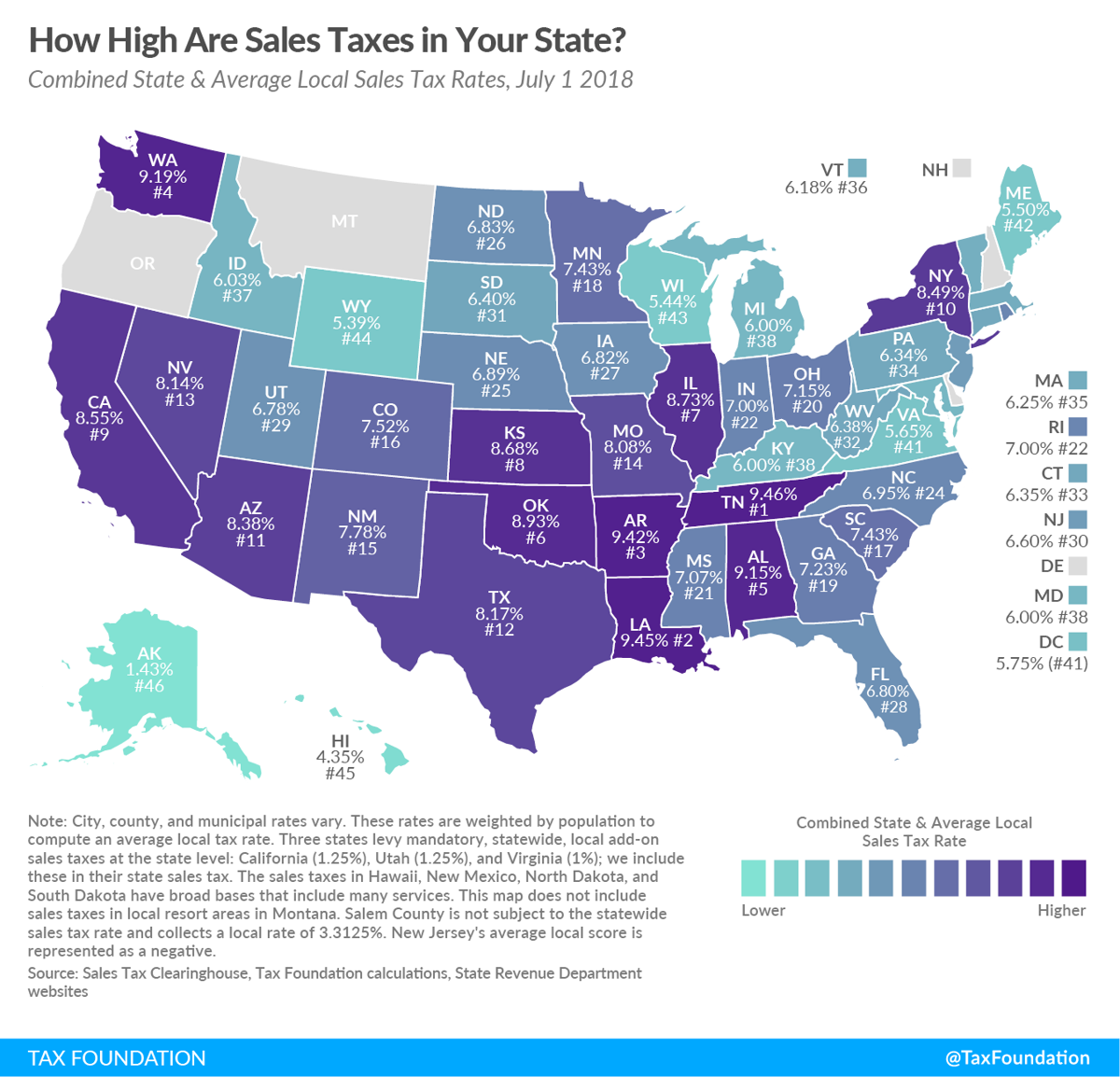

Nineteen major cities now have combined rates of 9 percent or higher. Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. Heres how Bexar Countys maximum sales tax rate of 825 compares to other counties around the United States.

The San Antonio Texas general sales tax rate is 625. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The minimum combined 2022 sales tax rate for San Antonio Texas is.

Wayfair Inc affect Texas. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 1000 City of San Antonio.

Local Governments Eminent Domain. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. City sales and use tax codes and rates.

There is no applicable county tax. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. The San Antonio sales tax rate is.

This is the total of state county and city sales tax rates. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2.

0500 San Antonio MTA Metropolitan Transit Authority. The current total local sales tax rate in San Antonio. Local Code Rate Effective Date.

The Texas sales tax rate is currently. 0125 dedicated to the City of San Antonio Ready to Work Program. This is the total of state county and city sales tax rates.

0250 San Antonio ATD Advanced Transportation District. San Antonio TX Sales Tax Rate The current total. There is no applicable county tax.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding California S Sales Tax

Understanding California S Sales Tax

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

How To Calculate Sales Tax On Almost Anything You Buy

Understanding California S Sales Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Texas Sales Tax Guide And Calculator 2022 Taxjar

Understanding California S Sales Tax

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com

Understanding California S Sales Tax

Why Are Texas Property Taxes So High Home Tax Solutions

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org